Monday February 2, 2015

3 Investment Lessons From The Super Bowl

Around the office this morning many of the conversations revolved around Seahawks offensive coordinator Darrell Bevell’s questionable play that lost them the Super Bowl. I got to thinking about the lesson he learned, and how it and a few others could be applied to investment strategy.

Around the office this morning many of the conversations revolved around Seahawks offensive coordinator Darrell Bevell’s questionable play that lost them the Super Bowl. I got to thinking about the lesson he learned, and how it and a few others could be applied to investment strategy.

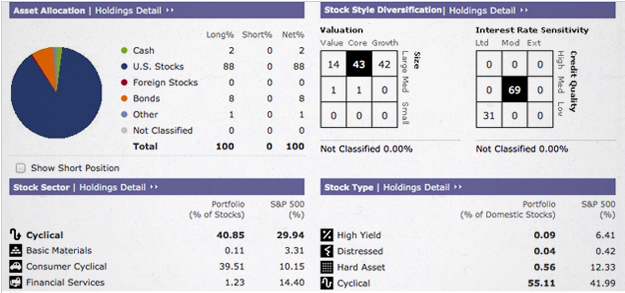

Don’t Get Fancy. Down by 4, on the 1 yard, with 25 seconds left in the game, Seattle tried to surprise the Patriots with the unexpected. Instead of using their powerhouse running back to punch through, they opted for a difficult slant pass hoping to catch the defense off guard. We all know what happened next. I see the same trickery in the financial industry. It’s built on the idea of outsmarting the opponent, known as the benchmark. There are all kinds of products designed to outperform, avoid loss, or guarantee whatever… Sounds good, but little to no evidence exists supporting long term validity of these new fancy strategies. It’s true that some investment managers actually outperform, but their outperformance is typically short lived. Evidence continues to suggest outperforming over the long term is impossible.

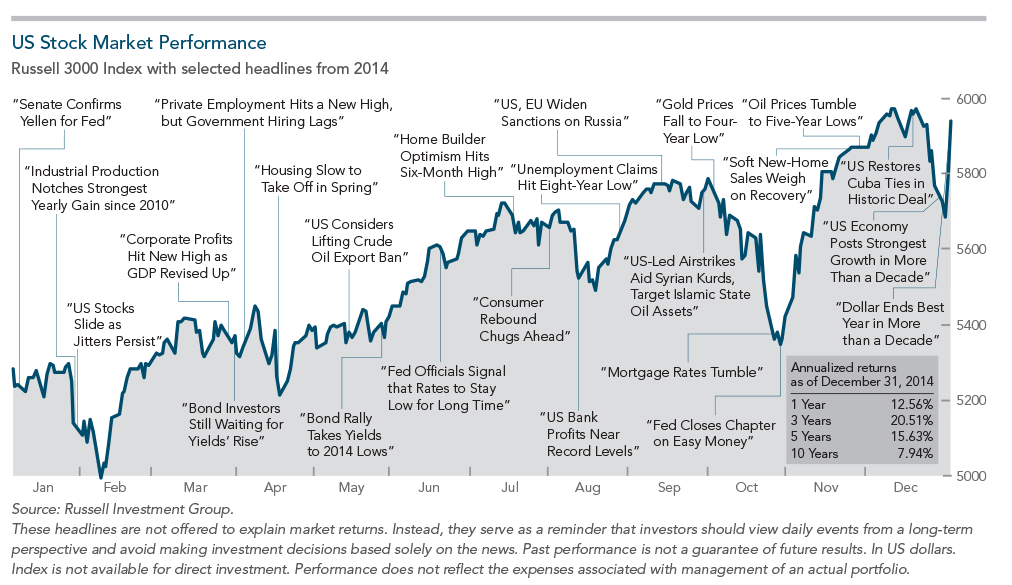

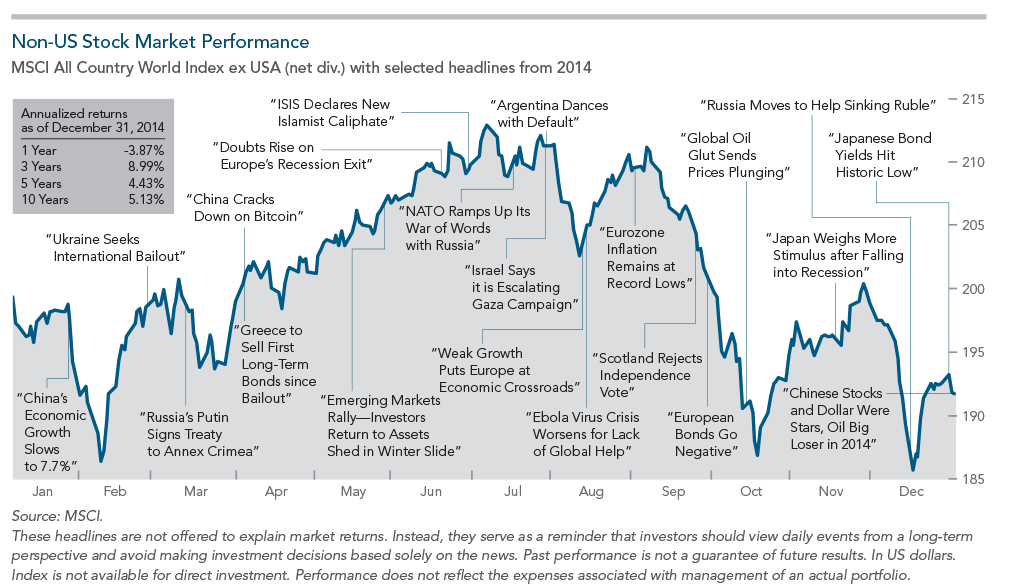

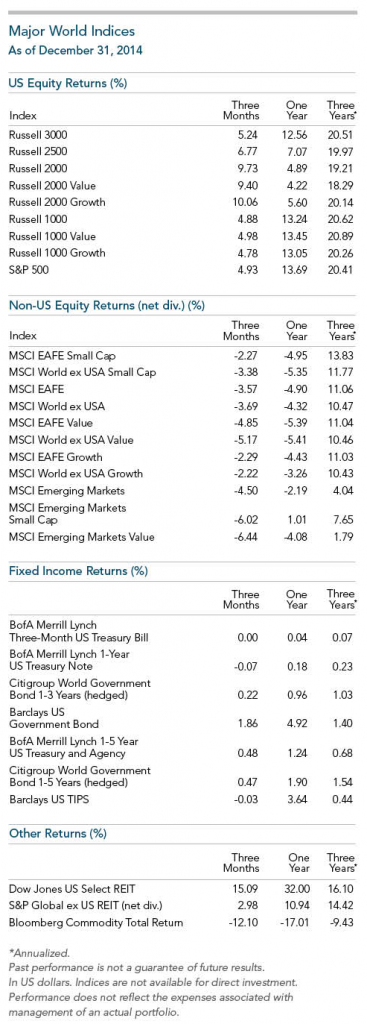

Be A Contrarian. Last year the Seahawks gave Denver a beat down in the Super Bowl. Their mid and long range defense crippled Peyton Manning, forcing him to throw little dinky tosses. The result was a game of Bronco turnovers and little yardage. So when everyone expected New England to try something new, what did they do? They didn’t change a thing. They went against conventional wisdom, and executed the same strategy that failed one year ago. In the financial industry, investors are lured into funds based on short term performance. It’s what the investing industry sells us! But when one examines the results of picking investments based on past performance, we learn that conventional wisdom doesn’t always work. In fact, yesterday’s winners turn out to be tomorrow’s losers!

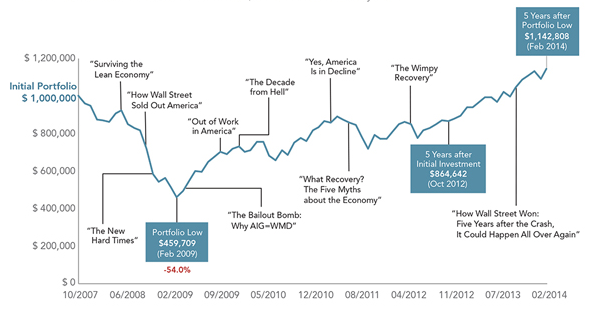

Don’t Give Up. We all saw undrafted Patriots rookie Malcolm Butler read the pass and then outmuscle Lockette for the interception. This was awesome! However, what’s AMAZING was Butler’s resolve in the face of near certain devastation as the clock ticked down. The Patriots were visibly dejected, and many thought Seattle would score. Not Butler. He continued to play as hard as he knew how until the end. It’s hard not to give up when the going gets tough. Like the Patriots defense on that drive, financial markets have faced scary situations. Investors who give in and bail out typically do so at the worst times. The most successful investors are the ones that stay committed, even when it’s hard. A patient stock investor should see an average annual return of around 10% (the S&P 500 has returned 10.1% from 1926 – 2013).

This appeared in my firm’s January newsletter, which came out on Monday. The recycled content (improved grammar, spelling, and verbiage at least somewhat) was too good not to pass on to everyone!

Thanks for reading!

– Greg Lessard, CRPC®