Monday January 19, 2015

2014 Market Review In Headlines

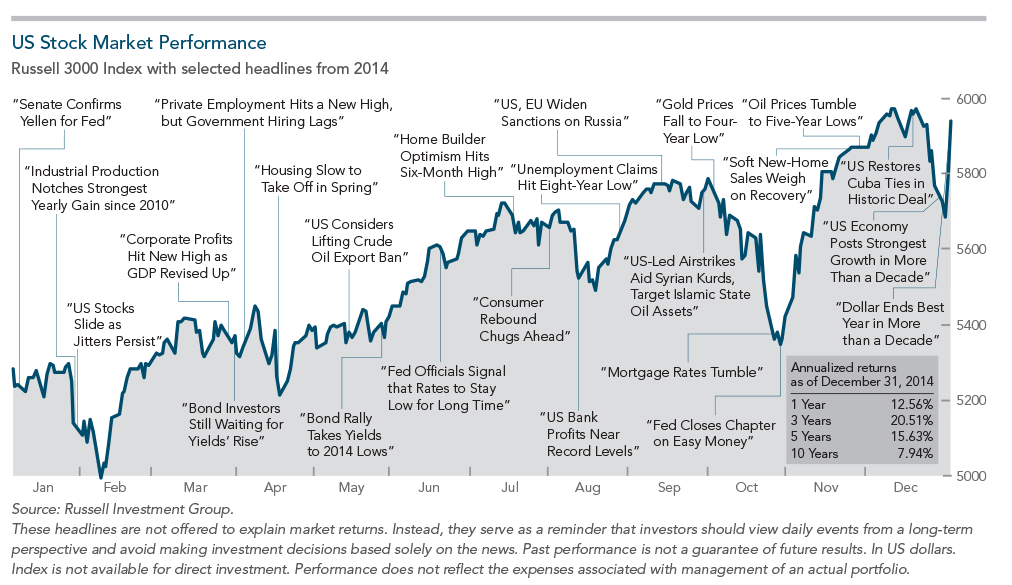

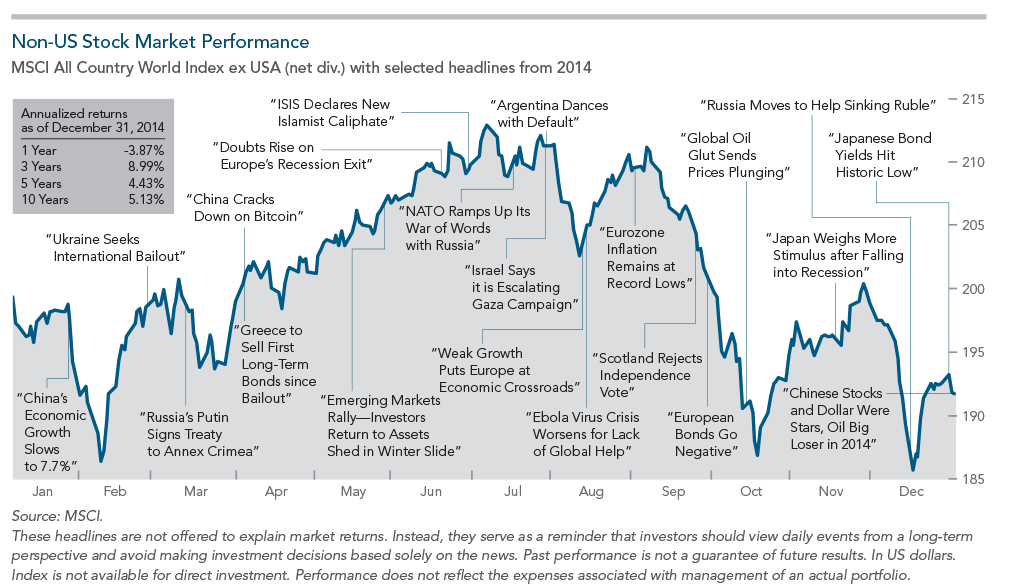

The chart above highlights some of the year’s prominent headlines in the context of broad US market performance, measured by the Russell 3000 Index. These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news. The next chart offers a snapshot of non-US stock market performance (developed and emerging markets), measured by the MSCI All Country World Index ex USA. Again, the headlines should not be viewed as determinants of the market’s direction but only as examples of events that may have tested investor discipline during the year.

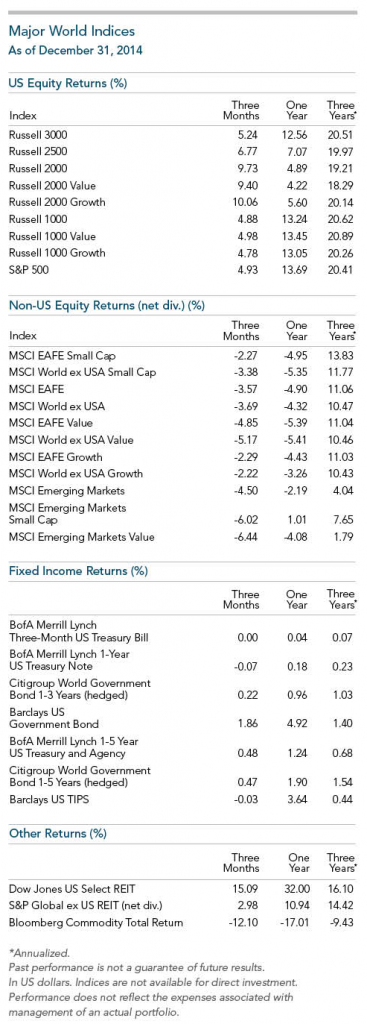

Within my financial advisory practice, I’ve been discussing how tilting towards different parts of the market has delivered above market returns (referred to as a “premium”). If you missed it, you can read more HERE (scroll down a bit). What investors should understand is that these above average returns aren’t consistent over time. Last year, US large cap stocks significantly outperformed small cap stocks, and within the relative price dimension, large value slightly outperformed large growth. Among small cap stocks, growth outperformed value. Negative returns among large and small caps stocks were similar, while large growth slightly outperformed large value. In the emerging markets, small cap, which had a slightly positive return, outperformed large cap, and growth outperformed value, although both returns were negative.

The mixed results of the size and relative price in 2014 were not unusual from a historical standpoint. Although small cap and value stocks have offered higher expected returns relative to their large cap and growth counterparts, these return premiums do not appear each year. For example, since 1979, US small caps have outperformed large caps in 19 of the 36 calendar years—or 52% of the time. Results are similar for the relative price dimension: Since 1979, value has outperformed growth in 20 calendar years—or 55% of the time. Small cap value has outperformed large cap growth in 58% of the calendar years.

History also has produced multiyear periods in which small caps and value did not outperform large caps and growth. Noteworthy periods include 1984 to 1987 and 1994 to 1998, when small caps underperformed large caps, often by a wide margin each year. Since 1979, the value premium has also experienced extended periods of underperformance—and, in some cases, the differential exceeded 15% margin. The same is true of small value vs. large growth stocks. In the three-year period from 2009 to 2011, both value and small caps underperformed. Yet, despite even extended negative-premium periods, small caps and value have outperformed over time, and when the premiums reversed, they often did so strongly and in multiple years.

Whatever happens in 2015, don’t be surprised. The market is unpredictable, so accept it. It can drop 10% in a week and then recover to finish the month strong. The headlines tracking these ups and downs can evoke very powerful emotions. It’s no wonder so many investors get caught up the mania we’re all bombarded with. Just remember, if your long term plan is solid, don’t change it based on short term news.

Thanks for reading and have a great day!

Greg Lessard, CRPC®

Leave a Reply