Monday December 8, 2014

Should I Add Commodities To A Globally Diversified Portfolio?

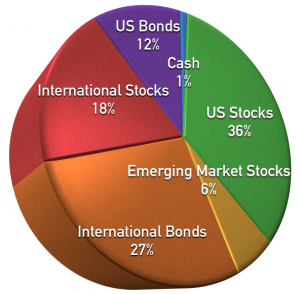

Probably not. Recently I ran two hypothetical tests on a basic,  globally diversified portfolio (the one you’re looking at to the right). The general allocation I used follows a traditional 60/40 blend of stocks and bonds. Since I wanted to test if commodities were worthy of a spot in my client’s portfolios, I used low cost, index style investments with slight “tilts” towards small company stocks as well as value stocks. If you want to know more about how an investor can benefit from this portfolio structure, you can read more HERE. To test the commodities position I used a broad based commodities ETF. Primarily I used Monte Carlo statistical analysis to project expected risk versus expected return over a 10 year time horizon. I also looked at back tested data to see which was the highest returning portfolio. First I tested an allocation of 3% to commodities, then decided to test a higher allocation (8%) to see if it created more of an impact one way or the other.

globally diversified portfolio (the one you’re looking at to the right). The general allocation I used follows a traditional 60/40 blend of stocks and bonds. Since I wanted to test if commodities were worthy of a spot in my client’s portfolios, I used low cost, index style investments with slight “tilts” towards small company stocks as well as value stocks. If you want to know more about how an investor can benefit from this portfolio structure, you can read more HERE. To test the commodities position I used a broad based commodities ETF. Primarily I used Monte Carlo statistical analysis to project expected risk versus expected return over a 10 year time horizon. I also looked at back tested data to see which was the highest returning portfolio. First I tested an allocation of 3% to commodities, then decided to test a higher allocation (8%) to see if it created more of an impact one way or the other.

A Portfolio Without Commodities Seems To Do Better

When I tested a 3% allocation to commodities, average annualized returns fell from 5.31% to 5.22%, and risk basically stayed the same. Big deal, right? However, when I tried an 8% allocation to commodities, annualized returns sank down to 5.06%. However, I did notice a measurable reduction in risk with the 8% allocation to commodities. Overall though, results suggest that adding commodities to a globally diversified portfolio hinders growth.

Challenges With The Hypothetical Test

First off, I tested adding commodities to a globally diversified 60/40 portfolio. Most people don’t actually a portfolio as diverse the underlying proxies I used in my test model. That said, adding commodities to a less diversified portfolio may provide a higher degree of benefit. Additionally, the test couldn’t account for portfolio rebalancing of any kind. Sorry, my research technology simply isn’t capable of that. However, most individuals aren’t familiar with the mechanics of when and how to rebalance anyway, so it’s probably pretty accurate real life behavior modeling.

The Big Picture and What You Can Do To Increase Return and Lower Risk

First off, get globally diversified. Here’s an excerpt from a recent newsletter I prepared for my clients:

Only 49% of the world’s investable stock, and 28% of the world’s investable bonds are US based. If an investor had only been invested in large, US companies over the decade January 2000 – December 2009, they would’ve seen a return of -9.1%. If they would have maintained a diversified global portfolio, they would have seen the following returns: 175.6% return in real estate, 48.7% return internationally, 121.3% return on US small company stocks, 154.3% return on emerging market stocks, and 82.0% return on government bonds.

Second, evaluate what you want to achieve from your investments. If you want to lower risk in an already diversified portfolio, then you might want to aim to include an 8% allocation to commodities. If your goal doesn’t just revolve around reducing risk, and you want to balance cost, tax efficiency, liquidity, and return, then you probably want to stay away from commodities.

Last, if you made it this far into the blog post and you have a headache, but still want to know if adding commodities to your portfolio makes sense, just ask me! It’s easy for me to plug commodities in with your current investment lineup to see what impact it creates. No cost, no commitments required.

Thanks for reading!

Greg Lessard, CRPC®

Leave a Reply