Tuesday December 16, 2014

Why You Should Avoid The Financial Media

We’re often told the more effort and energy we put into something, the better the result we’ll get. This couldn’t be farther from the truth when it comes to investing. Hyperactivity in investment attention is not well correlated with a high sense of investor control. Most of us could benefit from letting go of our negative habits of trying to stay plugged into financial media. This doesn’t mean that we shouldn’t do anything. What it means is you should have a general understanding of long term market trends, how your portfolio is constructed, and why your investments make the most sense for your big picture financial goals.

The Media Effect On Investor Behavior

This Businessweek cover is probably the most widely made fun of prediction for being so silly and wrong. This issue came out in August, 1979 about a few days before I celebrated my 1st birthday. Once the issue arrived at my parent’s house and I had a chance to glance at the cover, I immediately placed a call to my broker to sell my entire stock portfolio.

You’re probably chuckling at 1. the hilarity of this hypothetical scenario, and 2. that I actually had a photo on my 1 year birthday in which I’m holding a phone. While I make fun of this situation, it illustrates a valid point. If I actually had any invested money and reacted to this headline, I would’ve missed a whole lot (like, a real lot…). If I had stayed out of the market the 12 months following my stock sells, I would’ve missed a 14.76% gain. If I had stayed away five years, I would’ve missed a 51.94% gain. If I had stayed away until I was old enough to buy beer (legally like I should’ve) I would’ve missed a 1,073.35% gain. Had I never became a financial advisor or ever invested again, I would’ve missed a whopping 1,791.29% gain.

Why It’s Imperative You Don’t React To Media Garbage

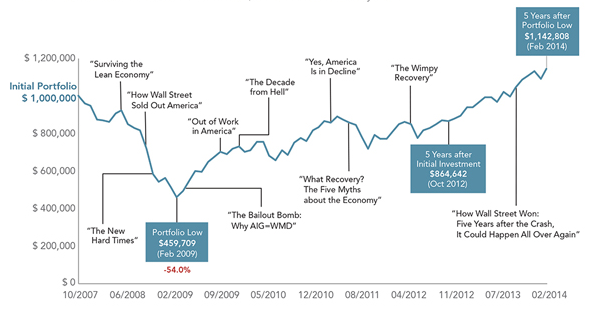

Since that fateful issue the financial media continues to pepper us with a constant barrage of attention grabbing headlines. Look at these valuable (sarcastically rolls eyes) recent headlines illustrating how absurd their timing is.

We have to remember two important lessons. First, the media is designed to capture our attention so it can continue to receive sponsorship dollars from advertisers. What they recommend or say should rarely be taken as valid investment advice. Second, any headline, advice, or strategy touted by anyone who isn’t your financial advisor is usually just entertainment. It’s extremely rare that what they recommend or say should ever be taken as valid investment advice (had to say it twice and in bold for effect)!

How To Increase Your Long Term Investment Success

Want to know the secret? Focus on what you can control. Here are 3 things you can control:

1. Understand risk. It’s important to understand the historical ups and downs of the market so you can pick a risk appropriate portfolio. Having knowledge of how a certain portfolio is likely to behave helps define your performance expectations, and it certainly helps keep you invested even when it’s hard.

2. Diversify broadly. A mix of US stocks, bonds, international investments, real estate, and other asset classes can drastically reduce risk. Also, remember to let go of your US investment bias. 72% of the world’s bonds and 51% of the world’s stocks are based outside the US!

3. Reduce Expenses. Higher fees don’t always correlate with better performance. In fact, most of the time the opposite is true. It’s not like buying a car where you’ll get more if you buy an Audi versus a low end Hyundai (sorry Mom, I know you love your Elantra). Investment dollars not siphoned off to investment expenses or tax inefficiencies add up over time.

Thanks for reading this post. I enjoyed researching and writing this blog “Why You Should Avoid The Financial Media”. If you have questions regarding your personal investments or how market events reported by the media should influence what you do, please reach out to me!

Here’s To Turning Off CNBC This Holiday Season,

Greg Lessard, CRPC®

Founder & President

Leave a Reply