Thursday September 25, 2014

Can You Commit To Your Asset Allocation?

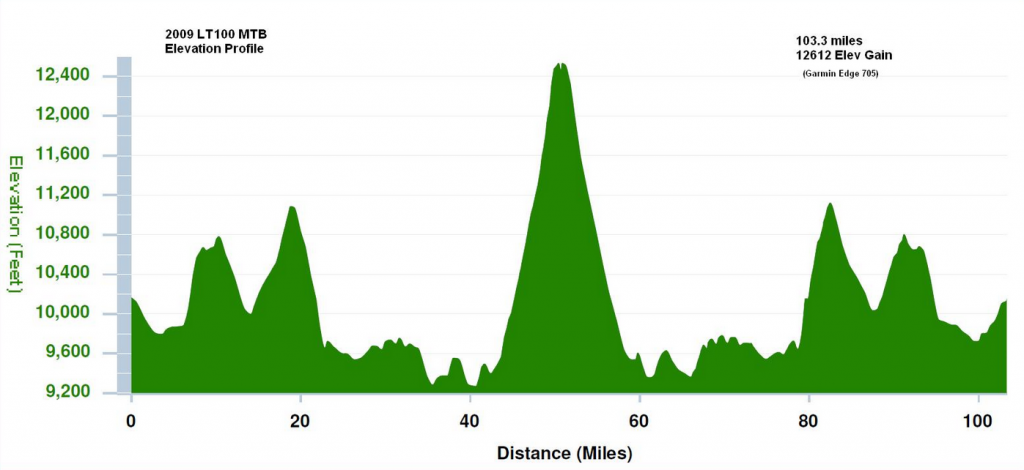

What if the chart below represented the next 12 months of stock market returns?

You’re actually looking at the elevation profile for a mountain bike race I did last August. I used this graph because I wanted to have a little fun, and there’s no denying it represents a bumpy ride whether you’re on a bike or invested in the market. It’s well known that in order for an investor to achieve a return, one must take risk. Risk is measured by volatility, and it’s how an investor reacts to this volatility that can dictate whether or not they achieve a good long term result.

Let’s assume the market plays out like the chart above. Attaining the top of the big spike in the middle represents the euphoria an investor feels after a stock market run up like the one in the late 90’s, ’03-’07, and ’09-today. Using the horizontal numbers for reference, what happens when an investor gets to mile 52? They usually get a little nervous and start questioning if this dip represents a recession. Once they get to mile 55 they are probably panicking hard, and on the verge of selling to go hide in cash or Treasuries. By mile 58 they are so exasperated they finally sell, and that’s the worse thing they can do.

Even though they feel better, they’ve actually just locked in their losses. So now what? They know they need growth in their accounts, but now they have to decide when to get back in. How long will it take them to regain confidence? Are they ready by mile 70, 85, or 104? The issue with my hypothetical investor is they sold when things were the worst, and waited too long to get back in. The other issue is this investor isn’t all that hypothetical. Investors have been doing this for decades.

An investor needs to understand the potential risks to their investments, and then commit to their asset allocation choice for the long term. Long term in the investment world should represent a time period lasting more than at least 10 years. The first step in determining an acceptable level of risk to take is by completing a risk questionnaire. The point of risk questionnaires is to establish a starting point for an asset allocation decision. Let’s assume the results of the questionnaire suggested an “aggressive” allocation.

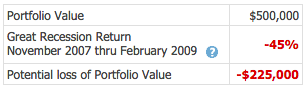

The more critical step is to then correctly interpret what the risk questionnaire is suggesting. To accomplish this, let’s assume the aggressive investor adopted a 90% stock / 10% bond allocation model. What would they say when I showed them the historical returns of the recommended allocation?

The most critical step is to either accept the recommended asset allocation or adjust to a less risky allocation. Many times an investor who is aggressive on paper isn’t actually up for accepting that kind of loss. Risk and asset allocation should be determined by a questionnaire along with a potential real world scenario.

A good financial advisor will not only guide you into an appropriate asset allocation, but they’ll be there when you’re at mile 55 & 60, panicking because you forgot your investment objectives were long term. A good financial advisor truly earns their fee when they help keep you calm during market downturns, and always takes time to explain why your asset allocation is still valid for your risk profile, long term investment objectives, and financial planning goals.

Thanks for reading! Feel free to leave a comment below or reach out to me directly if you have concerns about the investment risk you’re currently taking.

Leave a Reply