Monday January 26, 2015

Thinking About Ultra Short Duration Bond Funds For Safety? Go To The Bank Instead.

Occasionally I’m asked what investments to consider for a short time frame. My answer is always the same: NONE! If you’re saving for something short term (3-18 months) like a down payment on house, a tax bill, or a trip, trying to invest in something “safe” can surprise you. Even the safest sounding investments like “ultra short duration bond funds” can experience undesirable losses. The chart below shows the 12 month return of the SPDR SSgA Ultra Short Bond ETF (ULST). Bounces around a bit, doesn’t it?

My CNBC Fame

Ok… It’s just a little article, but I thought it was cool. Click the CNBC logo to read my quotes. In the article I discuss the merits of bond funds like the one above. While the author didn’t capture everything I said verbatim, she got my main point; an investor should be rewarded for the risk they’re willing to take, and based on current interest rates this type of bond fund might have to wait a while to see a positive real return.

Ok… It’s just a little article, but I thought it was cool. Click the CNBC logo to read my quotes. In the article I discuss the merits of bond funds like the one above. While the author didn’t capture everything I said verbatim, she got my main point; an investor should be rewarded for the risk they’re willing to take, and based on current interest rates this type of bond fund might have to wait a while to see a positive real return.

Ultra Short Duration Defined

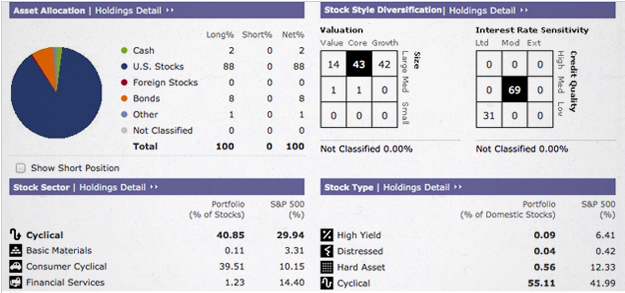

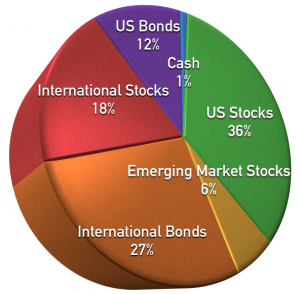

This type of fund invests in corporate, government, or a combination of both types of bonds with maturities of 1 year or less. At maturity, a bond holder gets their original investment back, and usually receives interest (technically dividends within an ETF) along the way as a reward for the risk taken. Duration reflects the amount of time expressed in years, a bondholder would have to wait to break even given an interest rate rise. There’s a lot that goes into the calculation, but simply put, the bigger the duration the more the bond price would be impacted if rates shot up. Historically, ultra short bond funds have been pretty boring, and right now there is a lot of hype around using them as hedges against rising interest rates.

The Potential Pitfalls With These Funds

First off, rates are pathetically low. The current yield on ULST is 0.36%. After taxes, inflation, and the potential for price declines, an investor is almost certain to lose money in the short term. Second, let’s say rates do rise this year. Will investors owning these funds be able to commit to holding onto them to recoup their investment via ETF dividend reinvestment? Maybe… Experience suggests that when investments decline further or faster than anticipated, it quickly becomes very difficult to stay invested.

The Alternative

When’s the last time a financial advisor told someone not to invest, but to use the bank instead? Like, never, said the financial advisor… Ok here’s a valid exception. As of today, Bankrate.com lists 23 banks offering 1-year CDs with APRs at 1% or more. ETFs are nice because you can sell them for cash at any time, unlike CDs that require a holding period to actually make money. However, CDs are FDIC insured. This means they’re safer investments (if one can actually call it that) than ultra short duration bond funds. At least at this point in time, why take on investment risk for a lower yield when you could buy a safer investment with a higher yield?

The Takeaway

If you want to earn something more than nothing on short term cash, don’t try to get fancy. It’s not worth the risk! Accept that you won’t make much on your short term investment, and just play it safe!

Thanks for reading. Due to the amount of advertising spam I get in the comments section, it’s very difficult to identify real inquiries and comments. As a temporary solution, please shoot me an email at greg@aspenleafllc.com with your questions or comments. Have a fantastic day!

Greg Lessard, CRPC®