Thursday January 8, 2015

How To Simplify Your Portfolio

In my year end newsletter to clients I talked about simplifying the financial planning process as well as reducing the number of investments in client portfolios. In this blog post I’ll be discussing why “less is better” if done correctly in an investment portfolio. First we’ll talk about why simplifying your investment portfolio is advantageous, then I’ll give you specific examples on how to simplify your portfolio.

In my year end newsletter to clients I talked about simplifying the financial planning process as well as reducing the number of investments in client portfolios. In this blog post I’ll be discussing why “less is better” if done correctly in an investment portfolio. First we’ll talk about why simplifying your investment portfolio is advantageous, then I’ll give you specific examples on how to simplify your portfolio.

Wait, Don’t I Need A Lot Of “Stuff” In My Portfolio?

No! When I speak with investors not currently working with my company, more often than not two themes appear with regular consistency. First, investors believe having a larger number of investments represents safety (that diversity thing). Second, when you look under the hood of their investment portfolio, I find people investing in a lot of the same stuff.

Challenging The Belief That More Investments Are Better

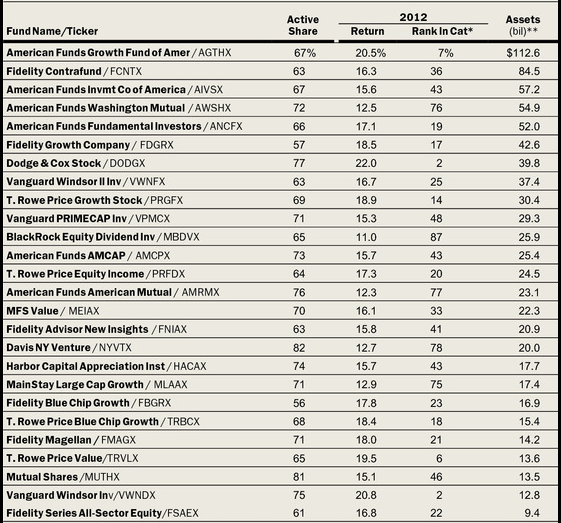

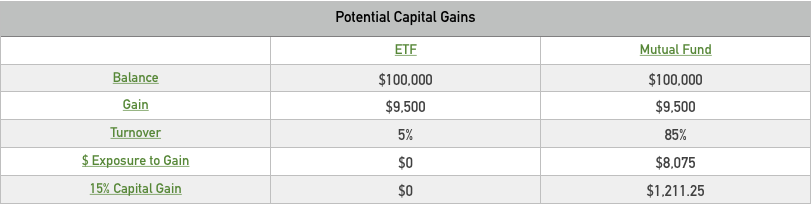

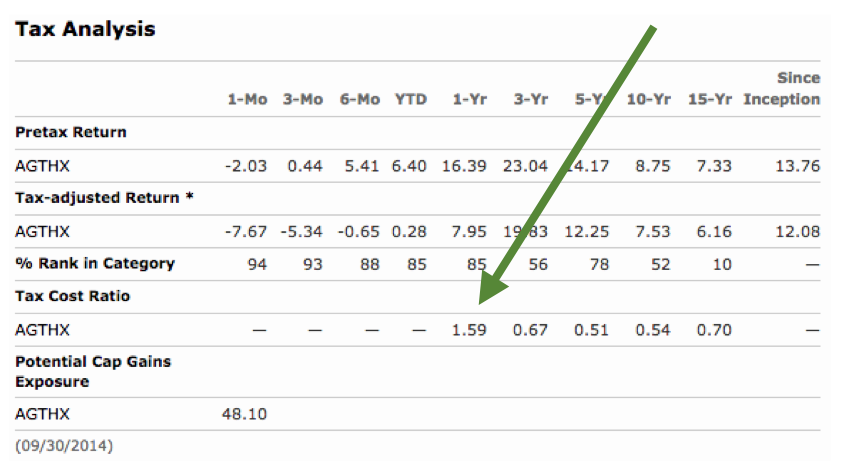

Most folks believe investing is complicated (maybe it is, but just a little). Therefore, they tend to feel more comfortable owning a portfolio of 12 mutual funds, 7 ETFs, and 15 stocks versus a portfolio of just 3 or 4 funds. While it’s possible to obtain fairly broad diversify with only a few funds, many people would feel they’re missing out on something. It’s easy to see why our investment behavioral bias would leave us feeling this way. What I’ve found is that when I explain the breadth of diversity they could achieve with fewer investments, most folks tend to relax their attitude that more is better. When I further show that reducing the amount of investments can maintain (and in many cases improve) diversification, reduce risk, improve tax efficiency, reduce trading costs, and lower fund expenses they really start to get on board. Once an investor has a basic education on proper portfolio design, they can usually let go of their old school thinking. They end up with that same “ahhhh” feeling you get after cleaning out your basement and dropping off all your unused stuff off at the thrift store. Investors who reduce portfolio clutter either on their own or by hiring me feel in control. When an investor feels in control, they become better equipped to be disciplined investors committed to the long term. How powerful!

When You Buy A Lot Of Stuff, Overlap Happens

When you have investment overlap, the portfolio you think you own isn’t the portfolio you actually own. Simply said, you may think you are investing in a balanced portfolio, but duplication in stocks or bonds can skew the portfolio more aggressively or more conservatively than your liking. Not good. It’s rare a portfolio actually represents what the investor believes it represents. To give you an example of overlap, you may own Apple stock, but it may also appear in your large cap growth fund, your S&P 500 index fund, your tech fund, and your world stock fund. With that kind of exposure, APPL stock could easily climb to 10 or 15% of your entire portfolio. Such concentration doesn’t align with diversification, does it?

Ok I’m Convinced I Need To Look Into This, What Do I Do?

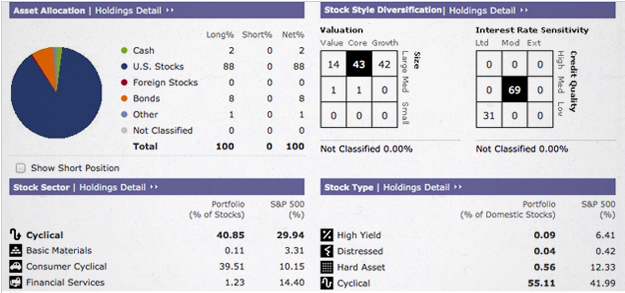

Well, without trying to come across like the typical salesman, call me! I can quickly create an analysis showing your stock, sector, and country overlap. Without even ever becoming a client a my company, we can discuss which investments can be eliminated, as well as asset classes you may be lacking (adding diversity). If you prefer, you can create a free account at Morningstar.com, and use their Portfolio Manager. Even in their free version, the analysis is fairly robust, giving you insight on where and what you’re invested in. Here’s a sample of part of the output you can generate.

If you’re not familiar with the style box analysis, or if you get bogged down trying to figure out which holdings can be eliminated, just let me know. I’ll get you back on track.

Putting All The Pieces Together

Once an investor determines what portfolio sprawl can be eliminated, they need to find differentiating investments to capture all parts of the investable universe. I accomplish this using index funds and exchange traded funds (ETFs), but you can also use mutual funds if that’s what you’re comfortable with. If you’re unsure what investments to buy, Morningstar offers free fund screeners for both ETFs and mutual funds. To give you an idea of what your new, refreshingly simple portfolio could look like, the portfolios I use with clients have 8 funds, contains over 20,00o individual stocks and bonds, invest in over 40 countries, and on average cost 0.26% in fund expenses. The returns aren’t too shabby either.

Remember, I’m here to help. I genuinely care about building inexpensive, globally diversified portfolios. It’s pretty easy to get bogged down with portfolio design. I can help you take the guess work out of it. Together we can raise your portfolio confidence and free up time so you can focus on other stuff in life. Thanks for reading and have a great day!

Greg Lessard, CRPC

Founder & President