Tuesday November 18, 2014

How To Insulate Your Portfolio When Markets Decline

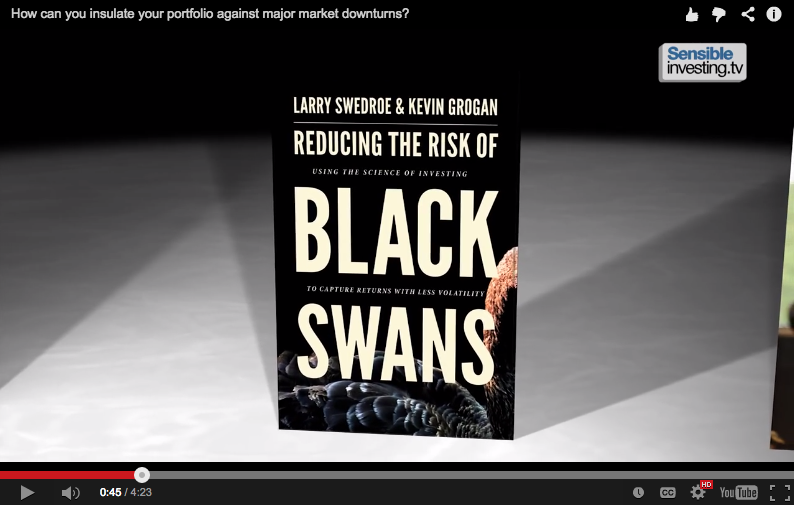

The financial credit crisis proliferating during 2008 was considered a “black swan” market. If you’re not familiar with the term, a black swan is any event that deviates from a normal expected outcome, making it difficult if not impossible to predict. Investors were rightfully shocked by losses the market suffered in 2008, and many panicked, only recently getting back in. Two financial advisors based on St Louis recently released a book describing how an investor can learn from the 2008 black swan market, as well as practical advice on how to design a portfolio that can help insulate your portfolio when markets decline. I’ve ordered the book for myself and if interested, you can find it HERE.

If you don’t have time or patience for the book (I don’t blame you), a friend and colleague of mine recently released a short video discussing the book’s highlights. Click the image below to watch the video.

Now that you’re an expert on how an overweight in value and small cap equities can reduce a diversified portfolio’s statistical bell curve tails (hahahhahah that was fun to say), let’s explore how this can be implemented and what its effect is on your long term financial plan.

HOW TO IMPLEMENT THIS STRATEGY

If you work with my financial advisory practice, we’re already doing this to an extent. I’ve been researching the benefits of overweighting value stocks and small cap stocks for over a year. Today I’m flying to Austin, TX to attend a two day workshop covering this portfolio design to cap off my studies. If you don’t work with my advisory practice, you can implement this with your own accounts at a discount brokerage like eTrade, TD Ameritrade, or Scottrade. Some 401K plans even have a robust enough fund lineup to employ the strategy. Your first step is to determine your target allocation (based on risk capacity, investment time horizon, general level of anxiety, etc), then go a bit more conservative by using a higher allocation to less volatile assets like bonds. Since bonds tend to drag on long term returns, you’ll want to mitigate the loss of return by overweighting to value stocks and small cap stocks. This can be accomplished using very specific mutual funds, or even better, index funds and ETFs. Many times a fund’s name will identify what type of strategy it sticks to. If you get stuck on finding these types of investments within your 401k or brokerage firm, ask me. I won’t charge you a fee, and I won’t hound you to death to become a client. Just making deposits in my karma bank.

WHY BOTHER DOING ANY OF THIS

Because if you’re nearing retirement or recently retired (5-10 years plus or minus), the sequencing of your portfolio returns matters! Research studies show how your portfolio behaves around the time you retire influences your ability to generate income. Here’s an example; if you retire and your portfolio takes a beating, it can take a long time to recover. Over the short term (3-7 years), a severe enough beating may rob you of a higher level of investment income you might have otherwise enjoyed. Over the long term (more than 10 years), your overall level of investment income will likely end up lower (with the portfolio beating) than had you taken steps to reduce investment risk. This is just another example of how managing risk in your investment portfolio makes a difference when looking at the big picture.

Thanks for reading my blog, and remember to share it with anyone you think would benefit from the content. Contact me if you want any additional information on this topic. Have a great day!

Leave a Reply