Wednesday November 5, 2014

Will Stocks Rise Based On Midterm Elections?

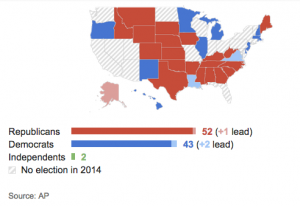

I enjoy looking at historical events and how they’ve shaped market returns. Tuesday’s midterm elections saw Republicans overtake Democrats for control of the Senate, giving them full control of Congress. In my state of Colorado, governor Hickenlooper has effectively defeated Republican challenger Bob Beauprez as most all the ballots have been counted as of 8 AM this morning. The state Senate seat went to Republican challenger Cory Gardner, who defeated incumbent Mark Udall for his spot. While midterm elections are important, I’m thankful all the annoying flyers and tv spots are over. Just let me watch the Broncos lose in peace…

I enjoy looking at historical events and how they’ve shaped market returns. Tuesday’s midterm elections saw Republicans overtake Democrats for control of the Senate, giving them full control of Congress. In my state of Colorado, governor Hickenlooper has effectively defeated Republican challenger Bob Beauprez as most all the ballots have been counted as of 8 AM this morning. The state Senate seat went to Republican challenger Cory Gardner, who defeated incumbent Mark Udall for his spot. While midterm elections are important, I’m thankful all the annoying flyers and tv spots are over. Just let me watch the Broncos lose in peace…

Looking back at midterm election years, investors have usually seen an end of year rally in the stock market. Some of this is fueled by the traditional seasonal market tailwind (I think everyone is in a better mood during the holidays, and therefore more likely to buy) in November and December. Since WWII, the stock market has averaged 16% growth in midterm election years. The S&P 500 is already up 9% YTD, so 16% may be a tall order by December 31st, but you never know. Occasionally, stocks have slumped from midterm election day through year end. This happened in 2002, 1994, and 1986 when the market lost -4%, -1.4%, and -1.6% respectively, in the final two months of trading.

What’s interesting is looking at whether a Democrat or Republican winning election favors better year ending stock market returns. Democratic investors would think they’d have an advantage when they win, and no doubt Republicans would feel the same way about their party. However, the data is just about evenly split. It really doesn’t matter what party wins. The stock market tends to rally a bit regardless of election results! This is probably due to the perception of change and the optimism it brings to investors. Whatever happens over the next two months, nothing is changing with portfolio models at my company. Making any change based on short term outlooks (good or bad) is a form of market timing intelligent financial advisors don’t subscribe to. Thanks for reading and have a great week!

Leave a Reply